san antonio general sales tax rate

San antonio city council approved on Thursday the sale of five properties it owned in. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

What Is The Austin Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Texas Comptroller of Public Accounts.

. Portland Oregon and Anchorage Alaska. 0125 dedicated to the City of San Antonio Ready to Work Program. The zone was established in 2000 to.

Sales s in Texas. They are followed by Chicago Illinois. 4 rows San Antonio.

Rate Effective Date. The 78216 San Antonio Texas general sales tax rate is. The San Antonio Puerto Rico sales tax is 600.

Cities at 10 percent. Bexar Co Es Dis No 12. 4 rows San Antonio collects the maximum legal local sales tax.

0250 San Antonio ATD Advanced Transportation District. San Antonio has a higher sales tax than 100 of Texas other cities and counties. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

12 San Antonio ATD. Automate your businesss sales taxes. And Seattle Washington each with rates of 95 percent.

Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825. The San Antonio Texas general sales tax rate is 625. Thus for example if a construction company located in San Antonio purchases a diesel -powered backhoe from a supplier located in Houston the construction company must pay tax on this purchase.

The current total local sales tax rate in San Antonio. Sales and Use Tax. Are charged at a higher sales tax rate than general purchases.

Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. 1000 City of San Antonio. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative.

Object moved to here. Texas imposes tax on sales of taxable item. View the printable version of city rates PDF.

Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community. San Antonios current sales tax rate is 8250 and is distributed as follows. The maximum possible tax rate is 825.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. 1000 City of San Antonio. Highest and Lowest Sales Taxes Among Major Cities.

City sales and use tax codes and rates. City Sales and Use Tax. San Antonios sales tax rate is 8125 percent.

Puerto Ricos sales tax rates for commonly exempted categories are listed below. Of course sales taxes are just one part of an. Sales Tax Versus Use Tax.

TX Sales Tax Rate. The San Antonio Texas general sales tax rate is 625. Some rates might be different in San Antonio.

Birmingham and Montgomery both in Alabama have the highest combined state and local sales tax rate among major US. The portion of the sales tax rate collected by San Antonio is 125 percent. The 825 sales tax rate in.

0500 San Antonio MTA Metropolitan Transit Authority. Download city rates XLSX. Our partner TaxJar can manage your sales tax calculations returns and filing for you so you dont need to worry about mistakes or deadlines.

Avalara provides supported pre-built integration.

Understanding California S Sales Tax

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Texas Sales Tax Rates By City County 2022

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Understanding California S Sales Tax

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Understanding California S Sales Tax

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Understanding California S Sales Tax

Understanding California S Sales Tax

Texas Sales Tax Guide For Businesses

Tax Proposals Comparisons And The Economy Tax Foundation

Understanding California S Sales Tax

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Sales Tax By State Is Saas Taxable Taxjar

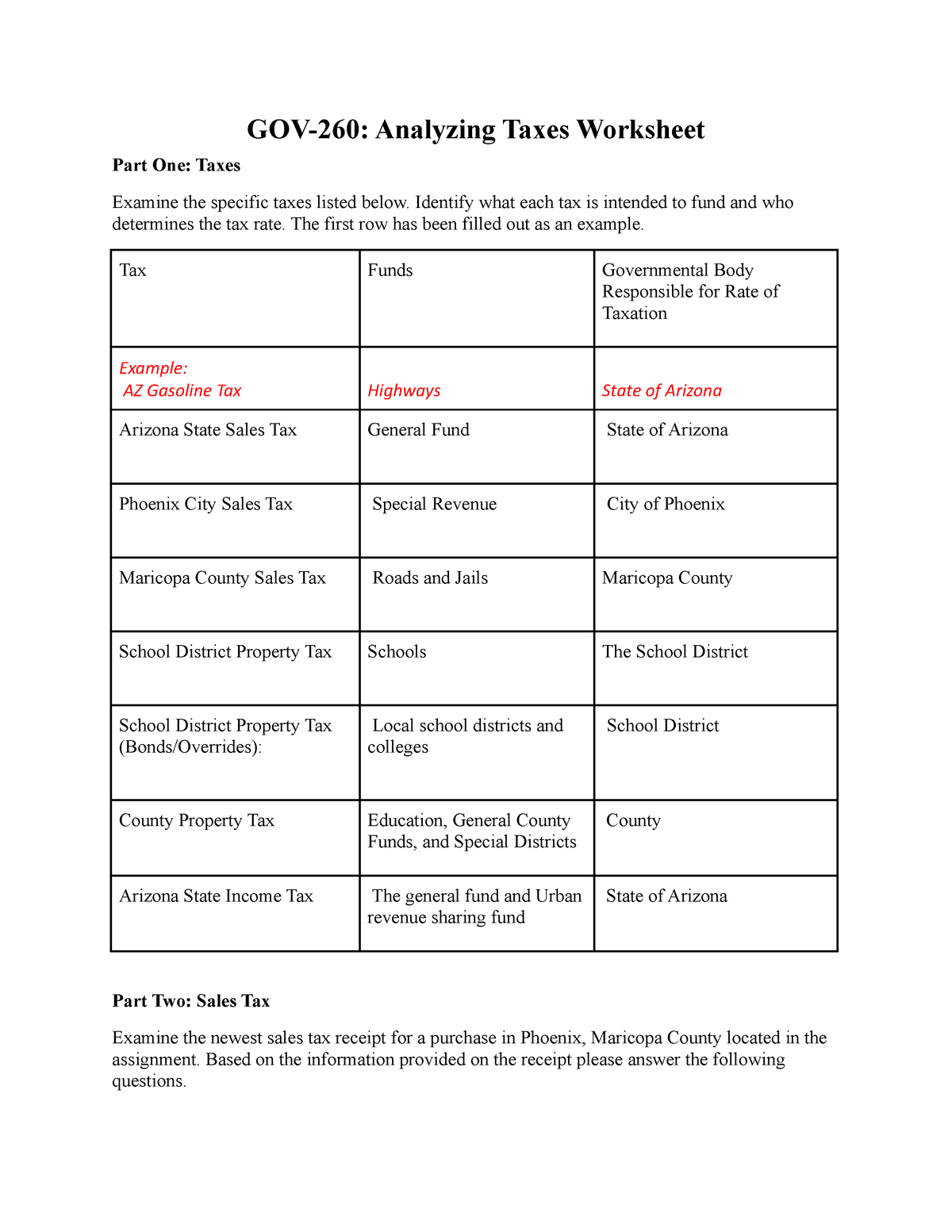

Analyzing Tax Worksheet 1 Gov 260 Analyzing Taxes Worksheet Part One Taxes Examine The Specific Studocu

Worksheet For Completing The Sales And Use Tax Return Form 01 117